Operational Risk Analysis in Financial Institutions – An Insight into Protecting Money and Managing Uncertainties

Welcome aboard, my young reader! Today, we’re going to dive into the exciting world of operational risk analysis in financial institutions. Yep, it may sound fancy, but don’t worry – I’m going to break it down for you in a way that’s easy to understand.

Let’s start by asking ourselves, what exactly is operational risk analysis? Well, it’s a process that helps financial institutions identify and manage potential risks that can arise from their day-to-day operations. From cybersecurity threats to human errors, these risks can seriously impact the stability and security of our hard-earned money. But fret not! Financial institutions use various tools and strategies to keep our funds safe and sound, and that’s where operational risk analysis comes into play.

So, why is this important for you to know, you may wonder? Understanding operational risk analysis helps us become more informed consumers and gives us a peek behind the scenes of the financial world. Plus, it’s never too early to start learning about managing risks and making smart financial decisions. Believe me, having this knowledge will come in handy once you start handling your own finances in the future.

Now that we’ve got the basics covered, let’s dive deeper into the intriguing realm of operational risk analysis in financial institutions. Get ready to explore the fascinating world where money, uncertainties, and protection intertwine. Exciting, isn’t it? So, let’s embark on this educational journey together!

Operational Risk Analysis in Financial Institutions: Ensuring Stability and Security

Operational risk analysis is a crucial aspect of the risk management framework for financial institutions. In today’s complex and interconnected financial landscape, it is essential for institutions to identify, assess, and mitigate operational risks to ensure stability and security. Through this article, we will delve into the intricacies of operational risk analysis in financial institutions, exploring its importance, methodologies, and key considerations.

The Significance of Operational Risk Analysis

Financial institutions face a multitude of risks, ranging from credit and market risks to liquidity and operational risks. Operational risk, in particular, refers to the potential losses arising from inadequate or failed internal processes, people, systems, or external events. Conducting thorough operational risk analysis allows financial institutions to proactively identify and manage these risks, making informed decisions to protect their operations, customers, and stakeholders.

Operational risk analysis provides financial institutions with valuable insights into the vulnerabilities and weaknesses within their organizational structures. By identifying and addressing these risks, institutions can enhance their overall resilience, improve their risk-adjusted returns, and maintain regulatory compliance. Furthermore, effective operational risk analysis can lead to increased investor confidence, as it demonstrates the institution’s commitment to proactive risk management and resource allocation.

The Methodologies of Operational Risk Analysis

There are various methodologies employed in operational risk analysis, each with its own strengths and limitations. One commonly used method is the Loss Distribution Approach (LDA). This approach involves analyzing historical loss data to estimate the frequency and severity of potential losses. By understanding the historical patterns of operational losses, financial institutions can develop models to predict and manage future risks.

Another widely used approach is the Scenario Analysis method, which involves identifying and analyzing specific scenarios that could give rise to operational risks. Institutions conduct stress tests and perform scenario simulations to assess the impact of potential adverse events, allowing them to identify vulnerabilities and develop contingency plans. This method is especially useful in assessing risks from emerging technologies, cyber threats, and external events.

Key Considerations in Operational Risk Analysis

When performing operational risk analysis, financial institutions must consider several key factors to ensure a comprehensive and effective assessment. Firstly, they must establish a robust framework for identifying and classifying various types of operational risks. This framework should encompass risks related to people, processes, technology, and external events, and it should align with industry best practices and regulatory requirements.

Additionally, financial institutions must ensure the availability and integrity of data used in operational risk analysis. Accurate and up-to-date data is essential for accurately assessing risks and implementing effective risk mitigation strategies. Institutions should also foster a culture of risk awareness and accountability, ensuring that employees are educated about operational risks and actively participate in risk identification and management.

Furthermore, technology plays a major role in operational risk analysis. Financial institutions should leverage advanced analytics tools and automated risk management systems to streamline their processes, enhance data analysis capabilities, and improve risk reporting. These technologies enable institutions to monitor and detect operational risks in real-time, facilitating timely interventions and minimizing potential losses.

Trends and Challenges in Operational Risk Analysis

Incorporating Artificial Intelligence for Enhanced Risk Analysis

As financial institutions face growing volumes of data and evolving risks, incorporating artificial intelligence (AI) into operational risk analysis is becoming increasingly important. AI models can analyze vast amounts of data, detect patterns, and identify potential risks with greater accuracy and efficiency. By leveraging AI, financial institutions can enhance their risk monitoring and prediction capabilities, enabling them to proactively address operational risks and improve decision-making.

The Importance of Continuous Monitoring and Adaptability

Operational risks are not static; they evolve over time due to various internal and external factors. Financial institutions must implement robust monitoring systems that continuously assess operational risks and adapt their risk management strategies accordingly. By maintaining a proactive and adaptable approach to operational risk analysis, institutions can effectively mitigate risks in dynamic environments and stay ahead of emerging threats.

Collaboration and Information Sharing

Operational risk analysis should not be confined within the boundaries of individual financial institutions. Collaboration and information sharing among institutions, industry associations, and regulatory authorities are crucial for identifying and managing systemic operational risks. By sharing best practices, exchanging knowledge, and collectively addressing emerging trends and challenges, the financial industry can enhance operational risk resilience and protect the broader financial system.

Key Takeaways: Operational Risk Analysis in Financial Institutions

- Operational risk refers to the potential for losses arising from inadequate or failed internal processes, systems, or human error in financial institutions.

- Financial institutions conduct operational risk analysis to identify, assess, and mitigate potential risks that could impact their operations and financial stability.

- Operational risk analysis involves evaluating the effectiveness of internal controls and procedures, assessing the impact of potential risks, and implementing measures to manage and mitigate those risks.

- Methods used in operational risk analysis include risk identification, risk assessment, risk monitoring, and risk reporting.

- Effective operational risk analysis helps financial institutions improve operational efficiency, maintain regulatory compliance, and safeguard their reputation and financial well-being.

Frequently Asked Questions

Operational risk analysis is a crucial aspect of managing risk in financial institutions. By understanding and analyzing operational risks, organizations can identify potential vulnerabilities and take preventive measures to mitigate them. Here are some commonly asked questions about operational risk analysis in financial institutions:

1. What is operational risk analysis and why is it important for financial institutions?

Operational risk analysis refers to the process of identifying, assessing, and managing potential risks that may arise due to the organization’s operational activities, systems, or processes. It is important for financial institutions because operational risks can have significant consequences, such as financial losses, reputational damage, and regulatory non-compliance. By conducting thorough operational risk analysis, institutions can proactively identify and address potential risks before they escalate.

Furthermore, operational risk analysis helps financial institutions enhance their overall risk management framework, improve operational efficiency, and strengthen their ability to meet regulatory requirements. It allows organizations to prioritize resources effectively and make informed decisions regarding risk mitigation strategies.

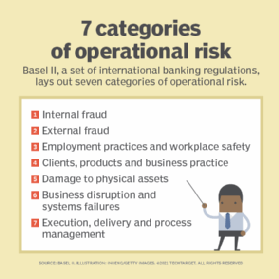

2. What are the common types of operational risks faced by financial institutions?

Financial institutions face a wide range of operational risks. Common types include:

- Internal fraud: Employee dishonesty, theft, or unauthorized activities.

- External fraud: Fraudulent activities perpetrated by external entities such as hackers or identity thieves.

- Technology failures: Disruptions or failures in IT systems, networks, or infrastructure.

- Business disruption: Events like natural disasters, pandemics, or power outages that disrupt normal operations.

- Compliance failures: Failure to adhere to regulatory requirements, leading to penalties or legal issues.

These are just a few examples, and the nature and extent of operational risks can vary based on the specific activities and operations of each financial institution.

3. How can financial institutions identify operational risks?

Identifying operational risks requires a systematic approach. Financial institutions can employ various methods, such as:

- Risk assessments: Conducting comprehensive assessments of the organization’s activities, systems, and processes to identify potential vulnerabilities.

- Internal controls: Establishing and reviewing internal control mechanisms to identify any weaknesses or gaps that could lead to operational risks.

- Incident reporting: Encouraging employees to report any incidents or near-misses that could indicate potential operational risks.

- External intelligence: Staying informed about industry trends, regulatory changes, and external factors that may contribute to operational risks.

It is essential for financial institutions to adopt a proactive approach to risk identification to stay ahead of potential threats.

4. What techniques are used in operational risk analysis?

Operational risk analysis involves various techniques to assess and analyze risks. Some commonly used techniques include:

- Root cause analysis: Investigating incidents or near-misses to identify the underlying causes and potential areas for improvement.

- Scenario analysis: Assessing the impact of potential risk events by simulating hypothetical scenarios and analyzing their potential consequences.

- Control self-assessment: Engaging employees at all levels to assess the effectiveness of control measures and identify areas of improvement.

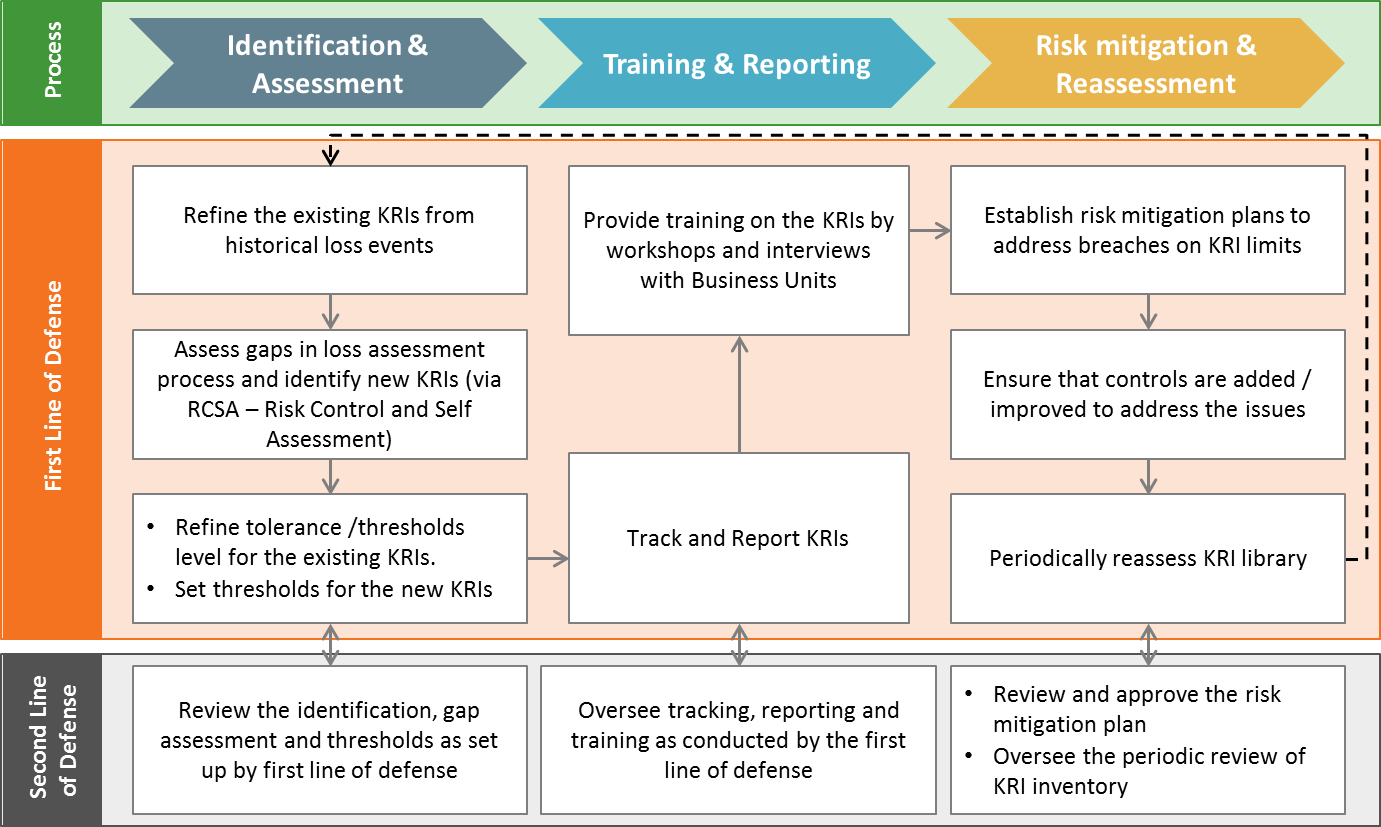

- Key risk indicators (KRIs): Monitoring and analyzing predefined metrics to identify early warning signs of operational risks.

These techniques provide financial institutions with valuable insights to measure and manage operational risks effectively.

5. How can financial institutions mitigate operational risks identified through analysis?

Once operational risks are identified through analysis, financial institutions can take several measures to mitigate those risks, including:

- Enhancing internal controls: Strengthening and implementing robust internal control mechanisms to prevent or detect potential risks.

- Implementing risk mitigation strategies: Developing and implementing strategies and action plans to address identified operational risks.

- Providing training and awareness: Educating employees about operational risks and their roles in risk management.

- Regular monitoring and review: Continuously monitoring and reviewing operational risks to ensure the effectiveness of mitigation measures.

- Developing contingency plans: Creating plans and procedures to handle unexpected events and minimize the impact on operations.

By taking proactive measures to mitigate operational risks, financial institutions can protect their business, reputation, and stakeholders’ interests.

Operational Risk Management in Financial Services

Summary

When it comes to financial institutions, understanding operational risk is super important. Operational risk means the chance that things could go wrong in the day-to-day operations of a bank or other financial company. It’s like those little hiccups that can happen, like computer problems or mistakes made by people. Figuring out these risks helps banks and other financial institutions keep their money and their customers safe. They use special analysis to identify and manage these risks, so they can be prepared for anything that might come their way. This way, they can keep the money flowing and avoid big disasters. So, even though it sounds complicated, operational risk analysis is basically just making sure everything runs smoothly in the world of finance.