Welcome to the fascinating world of cash flow analysis! In this article, we’re going to dive deep into the concept of cash flow analysis and uncover some hidden insights along the way. So, buckle up and get ready to explore how to effectively analyze cash flow and gain valuable insights from it.

Cash flow analysis is like solving a puzzle – it helps us understand the movement of money in a business. By examining the inflows and outflows of cash, we can paint a clear picture of a company’s financial health. But here’s the exciting part – hidden within those numbers are valuable insights that can shape strategic decision-making and drive business growth.

In this age of data-driven decision-making, cash flow analysis is a crucial tool for businesses of all sizes. It empowers you to make informed choices, identify trends, and spot potential risks or opportunities that may not be immediately visible. So, let’s embark on this journey together and uncover the hidden insights that lie within cash flow analysis. Buckle up!

Cash Flow Analysis: Uncovering Hidden Insights

Welcome to our in-depth guide on cash flow analysis. In this article, we will explore the importance of analyzing cash flow for businesses and individuals alike. By understanding the inflows and outflows of cash, you can gain valuable insights into the financial health and stability of an entity. Join us as we delve into the intricacies of cash flow analysis and uncover the hidden insights it can provide.

Why Cash Flow Analysis Matters

Cash flow analysis is a crucial tool for financial management. It allows businesses and individuals to understand the movement of money within a given period, typically monthly, quarterly, or annually. This analysis sheds light on the sources and uses of cash, helping identify strengths and weaknesses in financial operations. Whether you are a business owner, an investor, or an individual looking to manage your personal finances, cash flow analysis provides a comprehensive understanding of your financial situation.

By conducting a cash flow analysis, you can determine the profitability and sustainability of your operations. It helps you identify potential cash flow issues, such as periods of negative cash flow or a high reliance on external financing. Additionally, cash flow analysis enables you to make informed decisions about resource allocation, investment opportunities, and budgeting. It allows you to identify areas where you can optimize cash inflows, reduce unnecessary expenses, and improve overall financial performance.

Furthermore, cash flow analysis is essential for assessing the liquidity and solvency of a business or individual. It provides insights into the ability to meet short-term obligations, such as paying employees, suppliers, and creditors. By monitoring cash flow, you can ensure the availability of funds to cover immediate needs and avoid potential cash shortages or insolvency.

Steps to Conducting Cash Flow Analysis

Now that we understand the significance of cash flow analysis, let’s walk through the steps involved in conducting a thorough analysis.

Step 1: Gather Financial Statements

The first step is to gather the necessary financial statements, including the income statement, balance sheet, and statement of cash flows. These statements provide essential information about revenue, expenses, assets, liabilities, and changes in cash. Ensure you have accurate and up-to-date financial statements before proceeding with the analysis.

Step 2: Calculate Operating Cash Flow

Next, calculate the operating cash flow by adjusting net income for non-cash expenses and changes in working capital. This step helps determine the core cash generated from daily operations, excluding financing and investing activities. Operating cash flow is a key indicator of a company’s ability to generate consistent cash flow from its primary business activities.

Step 3: Analyze Investing and Financing Activities

After calculating operating cash flow, analyze the investing and financing activities. This involves reviewing capital expenditures, investments, loans, and other cash flows related to long-term assets and liabilities. Understanding the impact of these activities on overall cash flow is crucial for evaluating a company’s investment decisions and financial structure.

Step 4: Identify Cash Flow Patterns and Trends

Once you have analyzed the individual components of cash flow, identify any patterns or trends. Look for recurring cycles, seasonality, or changes in cash flow over time. This analysis can provide insights into the underlying drivers of cash flow and help predict future cash flow performance.

Step 5: Compare with Industry Benchmarks

Lastly, compare your cash flow analysis with industry benchmarks. This step allows you to assess your performance relative to peers and identify areas for improvement. Industry benchmarks provide a valuable reference point and can help you set realistic goals and targets for cash flow management.

By following these steps, you can conduct a comprehensive cash flow analysis and gain valuable insights into your financial situation. Whether you are a business owner, an investor, or an individual, understanding your cash flow is essential for making informed financial decisions and ensuring long-term financial stability.

The Benefits of Cash Flow Analysis

Now that we have explored the process of cash flow analysis, let’s delve into the benefits it offers. Cash flow analysis provides invaluable insights and advantages for businesses and individuals alike.

For Businesses

1. Improved Financial Decision-Making: Cash flow analysis helps businesses make better financial decisions by providing a comprehensive understanding of their cash inflows and outflows. It enables more accurate forecasting, budgeting, and resource allocation, leading to improved profitability and efficiency.

2. Enhanced Cash Flow Management: By analyzing cash flow, businesses can identify potential bottlenecks and inefficiencies in the cash conversion cycle. This enables them to implement strategies to optimize cash inflows, reduce expenses, and manage working capital effectively. Improved cash flow management enhances liquidity, reduces the need for external financing, and increases financial stability.

3. Early Detection of Cash Flow Issues: Cash flow analysis allows businesses to spot cash flow issues in their early stages. By monitoring cash flow patterns and trends, businesses can take proactive measures to address issues such as late customer payments, unexpected expenses, or stagnant inventory. Addressing these problems promptly helps prevent cash flow crises and ensures the smooth running of operations.

For Individuals

1. Informed Financial Planning: Cash flow analysis equips individuals with the information needed for effective financial planning. By understanding their cash inflows and outflows, individuals can budget wisely, save effectively, and plan for future expenses, such as education, homeownership, or retirement. It helps individuals make informed decisions about their financial goals and ensures long-term financial security.

2. Control Over Personal Finances: Analyzing cash flow provides individuals with greater control over their personal finances. It allows them to track and manage their expenses, prioritize financial goals, and avoid unnecessary debt. By understanding their cash flow, individuals can make conscious spending choices and develop healthy financial habits.

3. Improved Money Management: Cash flow analysis helps individuals identify areas where they can optimize their cash inflows and reduce expenses. This includes negotiating better terms with service providers, eliminating unnecessary subscriptions, and exploring opportunities to increase income. Improved money management leads to greater financial stability and the ability to achieve personal financial goals.

Cash Flow Analysis for Business Owners

Introduction: For business owners, cash flow analysis is a critical tool that provides insights into the financial performance, strengths, and weaknesses of their ventures. By understanding the intricacies of cash flow within their businesses, owners can make informed decisions about resource allocation, expansion opportunities, and financial stability.

Maximizing Cash Inflows

One of the key focuses of cash flow analysis for business owners is maximizing cash inflows. By identifying opportunities to increase revenue and accelerate the collection of accounts receivable, businesses can improve their cash flow position. Here are some strategies to consider:

- Offer Incentives for Early Payments: Encourage customers to pay their invoices promptly by offering discounts or incentives for early payment. This strategy can help accelerate cash inflows and reduce the reliance on customer credit.

- Improve Credit and Collection Processes: Implement robust credit and collection processes to minimize late payments or bad debts. Conduct thorough credit checks on new customers, establish clear payment terms, and follow up promptly on overdue invoices.

- Explore Additional Revenue Streams: Identify opportunities to diversify revenue streams and expand the customer base. This could involve launching new products or services, entering new markets, or targeting untapped customer segments.

By maximizing cash inflows, businesses can improve liquidity, reduce the need for external financing, and enhance overall financial stability.

Optimizing Cash Outflows

Equally important to maximizing cash inflows is optimizing cash outflows. Controlling expenses and managing working capital efficiently can significantly impact cash flow. Here are some strategies for business owners:

- Streamline Inventory Management: Implement effective inventory management systems to minimize carrying costs, reduce waste, and avoid excess inventory. Analyze demand patterns, establish reorder points, and consider just-in-time inventory strategies.

- Negotiate Supplier Terms: Negotiate favorable terms with suppliers to improve cash outflows. This could include extended payment terms, volume discounts, or rebates based on purchase volumes.

- Control Operating Expenses: Review operating expenses regularly and identify areas where costs can be reduced or eliminated. This may involve renegotiating contracts, implementing energy-saving measures, or outsourcing non-critical functions.

By optimizing cash outflows, businesses can free up cash for other purposes, reduce financial strain, and improve overall cash flow.

Leveraging Cash Flow Analysis in Personal Finance

Introduction: Cash flow analysis is not only valuable for businesses but also for individuals seeking to manage their personal finances effectively. By understanding their cash inflows and outflows, individuals can gain control over their finances and make informed decisions about saving, spending, and investing.

Budgeting for Financial Success

Cash flow analysis is at the core of effective budgeting for personal finance. By tracking income and expenses, individuals can develop a budget that aligns with their financial goals. Here are some steps to consider:

- Track Income and Expenses: Begin by recording all sources of income and categorizing expenses. This allows you to visualize how your money is being utilized and identify areas for improvement.

- Identify Essential and Discretionary Expenses: Differentiate between essential expenses, such as housing, utilities, and food, and discretionary expenses, such as entertainment and dining out. This helps prioritize spending and ensure essential needs are met first.

- Set Realistic Saving Goals: Based on your analysis, set realistic saving goals. Allocate a portion of your income to savings, emergency funds, and investments. This ensures future financial security and allows you to make progress towards your financial objectives.

By budgeting effectively, individuals can make conscious spending choices, avoid debt, and achieve long-term financial success.

Gaining Financial Awareness

Cash flow analysis provides individuals with financial awareness, allowing them to understand the bigger picture of their financial situation. Here are some benefits of gaining financial awareness:

- Reduced Financial Stress: By analyzing cash flow, individuals can identify potential financial stressors, such as excessive debt or unsustainable spending habits. Addressing these issues proactively reduces financial stress and improves overall well-being.

- Early Detection of Problematic Spending Patterns: Cash flow analysis helps individuals identify problematic spending patterns, such as overspending in certain categories or impulsively making unnecessary purchases. Armed with this knowledge, individuals can implement strategies to curb spending, such as setting budgets or seeking financial counseling.

- Improved Financial Decision-Making: Understanding cash flow allows individuals to make informed financial decisions. They can assess the trade-offs of different options, evaluate the impact on cash flow, and make choices that align with their long-term financial goals.

By gaining financial awareness through cash flow analysis, individuals can take control of their personal finances and achieve greater financial stability.

Investment Opportunities

Cash flow analysis can also help individuals identify investment opportunities and make informed decisions about allocating their financial resources. Here are some considerations when investing:

- Assess Investment Risks and Returns: Evaluate the risks and potential returns of different investment options. Consider the liquidity of the investment, the potential for capital appreciation, and the associated risks.

- Align Investments with Cash Flow Goals: Ensure that your investment choices align with your cash flow goals. Consider the time horizon for your investments and the potential impact on your cash flow position.

- Diversify Your Portfolio: Spread your investments across different asset classes to minimize risk. Diversification helps protect against significant losses and increases the potential for consistent returns.

By leveraging cash flow analysis, individuals can make informed decisions about investing and optimize their financial resources for long-term growth.

Final Thoughts

In conclusion, cash flow analysis is a powerful tool for uncovering hidden insights in both business and personal finances. Whether you are a business owner seeking to optimize operations or an individual looking to manage your personal finances better, understanding your cash flow is essential. By conducting a thorough cash flow analysis, you can gain valuable insights into the inflows and outflows of cash, identify potential issues, and make informed financial decisions. Remember, cash flow analysis is an ongoing process that requires regular monitoring and adjustment. By taking control of your cash flow, you can pave the way for financial success and stability.

Key Takeaways: Cash Flow Analysis

- Understanding cash flow analysis helps uncover hidden insights about a business’s financial health.

- It involves analyzing the inflows and outflows of cash to assess liquidity and solvency.

- Identifying cash flow patterns can reveal trends and potential financial risks.

- Cash flow can provide insights into a company’s ability to generate profits and pay debts.

- Proper analysis of cash flow can aid in decision making and financial planning for businesses.

Frequently Asked Questions

When it comes to cash flow analysis and uncovering hidden insights, many people have questions. Here are some frequently asked questions and their answers.

1. How can cash flow analysis help my business?

Cash flow analysis is a powerful tool that provides insights into your business’s financial health. By examining the movement of cash in and out of your business, you can gain a deeper understanding of your income, expenses, and liquidity. It helps you identify trends, predict future cash flows, and make informed decisions about budgeting, investments, and borrowing. Additionally, cash flow analysis can uncover potential cash flow problems before they become significant issues, giving you the opportunity to take proactive measures.

Ultimately, understanding your business’s cash flow through analysis enables you to make strategic decisions that can drive growth and ensure financial stability.

2. What are the key components of cash flow analysis?

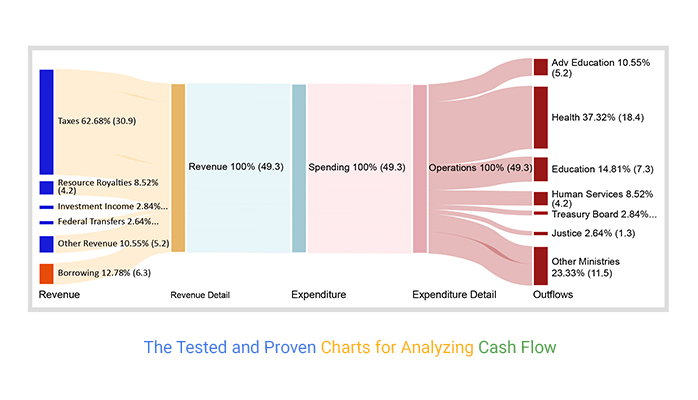

In cash flow analysis, there are three primary components that need to be considered: operating activities, investing activities, and financing activities. Operating activities involve the cash flows from day-to-day business operations, such as sales, expenses, and inventory changes. Investing activities include cash flows from buying or selling assets, like equipment or property. Financing activities encompass cash flows related to borrowing or repaying loans and issuing or buying back shares.

By examining these three components, you can gain a comprehensive view of your business’s cash flow and identify areas where improvements can be made. Each component contributes to the overall financial health of your business, and analyzing them individually and collectively provides valuable insights.

3. How frequently should I conduct cash flow analysis?

Regular cash flow analysis is crucial for staying on top of your business’s financial health. While the frequency may vary depending on your industry and business size, it’s generally recommended to conduct cash flow analysis on a monthly basis. This allows you to track short-term trends, identify any financial bottlenecks, and make timely adjustments.

However, it’s also important to conduct more comprehensive and in-depth cash flow analysis on a quarterly or yearly basis. This allows you to assess long-term trends, evaluate the effectiveness of your financial strategies, and make informed decisions about future growth and investment.

4. What are some common cash flow issues to watch out for?

There are several common cash flow issues that businesses should be aware of:

– Negative cash flow: This occurs when your business is spending more cash than it’s generating, potentially leading to financial instability.

– Inconsistent cash flow: Fluctuations in cash flow can make it challenging to meet regular financial obligations and plan for the future.

– Poor cash flow management: Inefficient handling of cash inflow and outflow can result in missed opportunities, late payments, and unnecessary expenses.

By keeping a close eye on these issues and conducting cash flow analysis, you can address them proactively and take steps to improve your business’s financial situation.

5. How can I use cash flow analysis to improve profitability?

Cash flow analysis can be instrumental in improving profitability. By examining your cash flow, you can identify areas where you can cut costs, increase revenue, or optimize operations.

For example, you may discover that certain products or services generate higher cash inflows, allowing you to focus on those areas and enhance their profitability. Additionally, cash flow analysis can shed light on expenses that may be draining your resources unnecessarily, giving you the opportunity to reduce or eliminate them.

Furthermore, by understanding your cash flow patterns and trends, you can make informed decisions about pricing, discounts, payment terms, and inventory management, all of which can contribute to increased profitability. Cash flow analysis empowers you to align your financial strategies with your business goals and maximize your bottom line.

Summary

Cash flow analysis helps us understand the money coming in and going out of a business. By looking closely at cash flow, we can uncover hidden insights that can improve financial decisions. It’s important to track not just profits, but also the timing of cash inflows and outflows. This analysis helps businesses plan for the future and avoid cash flow problems.

One key component of cash flow analysis is understanding the difference between cash flow from operations, investing, and financing activities. By separating these categories, we can identify where money is being generated or spent. Another important concept is free cash flow, which tells us how much money a business has left after paying for its operations and investments. By analyzing cash flow, businesses can make better financial decisions and ensure the long-term success of their operations.