If you’ve been keeping an eye on the real estate market, you’re probably wondering: “Where will mortgage interest rates go next?” It’s a burning question that affects homeowners, homebuyers, and even those just thinking about entering the market. And let me tell you, my friend, I’ve got some insights for you.

Now, I may not have a crystal ball, but I can certainly shed some light on this topic. Because when it comes to mortgage interest rates, there are a lot of factors at play. The economy, inflation, government policies, and even global events can all influence where those rates are headed.

But fear not, because I’ve got your back. In this article, we’ll dive into the factors that impact mortgage interest rates and explore some expert predictions. So, buckle up and let’s take a journey into the fascinating world of mortgage rates!

Now, let’s get one thing straight – predicting mortgage interest rates is no easy task. It’s like trying to predict the weather or what your little brother will have for breakfast tomorrow. But with a bit of research and a touch of intuition, we can uncover some valuable insights. So, get ready to navigate the twists and turns of the mortgage market as we unravel the mystery of where those interest rates might be headed next. Exciting, right? Let’s dive in!

Where Will Mortgage Interest Rates Go Next?

In recent years, the housing market has been a hot topic, with mortgage interest rates playing a crucial role in homebuyers’ decisions. Whether you’re a first-time buyer or a seasoned homeowner, understanding the direction of interest rates is essential for making informed decisions about your mortgage. So, where will mortgage interest rates go next? In this article, we will delve into the factors that influence mortgage rates and explore the current trends and predictions that can help you gain insights into what the future holds.

The Federal Reserve and Mortgage Interest Rates

The Federal Reserve, often referred to as the Fed, has a significant impact on mortgage interest rates. The Fed is responsible for implementing monetary policies to promote economic stability. One of the key tools it uses is adjusting the federal funds rate, the interest rate at which depository institutions lend to each other overnight. Although the federal funds rate does not directly affect mortgage rates, it does influence them. When the Fed lowers or raises the federal funds rate, it sends ripples throughout the financial markets, affecting long-term interest rates, including those for mortgages.

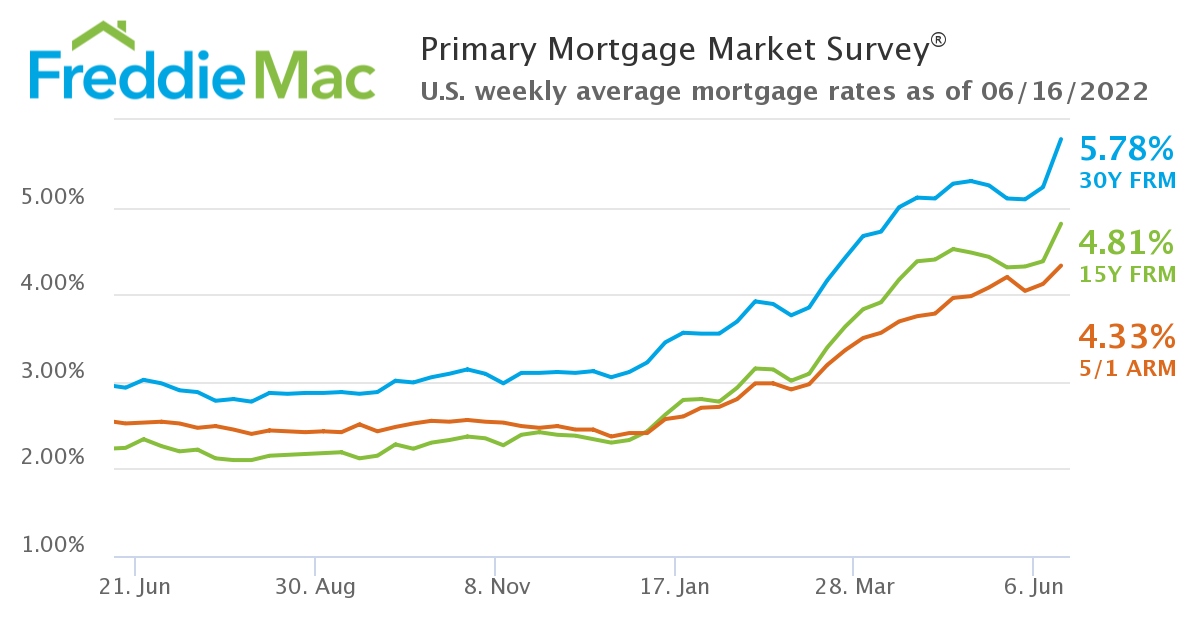

In recent times, the Fed has adopted an accommodative stance, keeping interest rates low to support the economy amidst the challenges posed by the COVID-19 pandemic. This has contributed to historically low mortgage rates, enticing homebuyers and homeowners to take advantage of favorable borrowing conditions. However, as the economy continues to recover and inflation pressures mount, the Fed may consider adjusting its monetary policy, potentially leading to higher interest rates.

The Impact of Economic Factors

While the Federal Reserve plays a crucial role, various economic factors can also influence mortgage interest rates. Let’s take a closer look at some of these factors:

- Economic Growth: When the economy is thriving, with low unemployment rates and strong GDP growth, it often leads to increased demand for borrowing. This heightened demand can drive interest rates higher to maintain a balance between supply and demand.

- Inflation: Inflation erodes the purchasing power of money over time. Lenders require compensation for the potential loss of value due to inflation. Therefore, higher inflation expectations can result in higher mortgage rates.

- Government Policies: Government policies, such as tax incentives for homeownership or changes in regulations, can affect the housing market and ultimately impact mortgage rates.

- Global Economic Conditions: Global economic conditions, such as geopolitical events, trade wars, or economic crises in other countries, can lead to shifts in global capital flows and influence interest rates in the United States.

Considering these factors, it’s important to stay informed about economic indicators and trends to gauge the direction of mortgage interest rates.

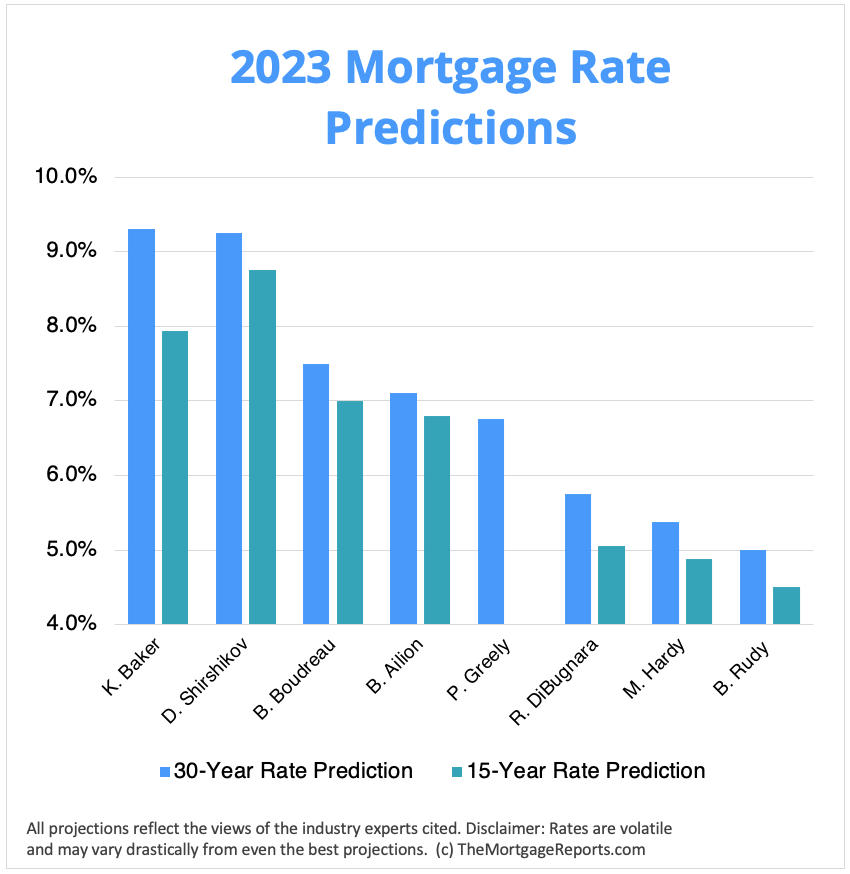

Market Projections and Expert Opinions

Market projections and expert opinions can provide valuable insights into where mortgage interest rates are headed. While no one can predict the future with certainty, analyzing data and expert opinions can help identify trends and potential factors that may influence rates. Financial institutions, economists, and industry experts often publish reports and forecasts on interest rates.

It’s also worthwhile to closely follow economic news, as statements from influential figures, such as central bank officials or government authorities, can provide hints about potential interest rate changes. Additionally, keeping an eye on key economic indicators, such as GDP growth, housing market data, and inflation rates, can help identify trends and potential shifts in mortgage rates.

However, it’s important to remember that predictions are not guarantees. Mortgage interest rates are influenced by a complex web of variables, and unexpected events can impact them. Therefore, while market projections can provide valuable insights, it’s essential to consider them alongside your personal financial goals and circumstances.

Considerations for Homebuyers and Homeowners

For homebuyers and homeowners, the direction of mortgage interest rates is a critical factor to consider. Here are a few key points to keep in mind:

- Timing: Timing your mortgage application or refinancing can be crucial to take advantage of favorable interest rates. Understanding the market trends and projections can help you make an informed decision about when to lock in your rate.

- Budgeting: Higher interest rates translate to higher monthly mortgage payments. If rates are anticipated to rise, it’s important to budget accordingly, ensuring that you can comfortably afford your mortgage payments.

- Flexibility: Flexibility in your mortgage terms can provide added security in a changing interest rate environment. Options such as adjustable-rate mortgages (ARMs) or hybrid loans can offer initial lower rates, but it’s essential to understand the potential risks and plan for potential rate adjustments in the future.

Ultimately, the decision of where mortgage interest rates will go next is influenced by a multitude of factors, both economic and global in nature. By staying informed about these factors and keeping an eye on market trends and expert opinions, you can make more educated decisions about your mortgage. Remember to consult with a trusted mortgage professional for personalized guidance tailored to your specific situation.

Key Takeaways: Where Will Mortgage Interest Rates Go Next?

- Mortgage interest rates can go up or down depending on various factors.

- Factors that influence mortgage interest rates include government policy, inflation rates, and economic conditions.

- It’s challenging to predict exactly where mortgage interest rates will go next.

- Consulting with a mortgage expert can help provide insights into potential future trends.

- Monitoring economic indicators and staying updated on market news can also give an idea of where rates may be heading.

Frequently Asked Questions

Welcome to our Frequently Asked Questions section all about mortgage interest rates and their future trends. If you’re curious about where mortgage interest rates are headed next, you’ve come to the right place. Read on to find answers to some of the most common questions.

1. Are mortgage interest rates expected to rise or fall in the near future?

While it’s impossible to predict mortgage interest rates with certainty, experts suggest that rates may rise in the coming months. This speculation is largely based on factors such as economic indicators, inflation rates, and the monetary policies of central banks. However, it’s important to note that predictions are not guaranteed outcomes. It’s always a good idea to stay informed by following mortgage trends and consulting with professionals.

In the end, whether rates will rise or fall depends on various market forces, including both national and global economic factors. It’s wise to keep an eye on these indicators and consider speaking with a mortgage advisor to gain a better understanding of current trends and how they may impact interest rates for home loans.

2. What factors influence mortgage interest rates?

Several factors influence the fluctuation of mortgage interest rates – some of which include the state of the economy, inflation rates, and the policies of central banks. Additionally, the demand for mortgages and the current supply of funds also play a significant role. By analyzing these factors and others, financial institutions and economists can make informed predictions about future interest rate changes.

It’s worth noting that interest rates may differ among lenders due to individual creditworthiness and loan terms. Factors like credit score, loan amount, down payment, and loan type can all impact the specific interest rate offered to a borrower. Therefore, it’s important to shop around and compare offers from different lenders to ensure you get the best possible rate.

3. How do mortgage interest rates affect housing affordability?

Mortgage interest rates have a direct impact on housing affordability. When mortgage rates are lower, it generally means that monthly mortgage payments will be more affordable for borrowers. This can make homeownership more accessible for a wider range of individuals, including first-time buyers. Conversely, higher interest rates can increase monthly mortgage payments, potentially making homes less affordable for some buyers.

That being said, mortgage interest rates are just one piece of the puzzle when it comes to affordability. Other factors like housing prices, income levels, and personal financial situations also play significant roles. It’s crucial for potential homebuyers to carefully consider their own financial circumstances and do the math to determine what they can comfortably afford, regardless of the current interest rates.

4. Should I wait to apply for a mortgage if interest rates are projected to decrease?

Deciding whether to wait for a projected decrease in interest rates before applying for a mortgage depends on a variety of factors. While a lower interest rate may be beneficial in terms of lower monthly payments, it’s essential to consider other factors and weigh the pros and cons. For example, waiting for rates to decrease may mean delaying homeownership and potentially missing out on favorable housing market conditions or price appreciation.

It’s also important to remember that no one can accurately predict when interest rates will rise or fall. Even with expert analysis, unexpected events can influence rates. Therefore, it’s best to consider factors such as your financial readiness, housing market conditions, and personal goals when deciding whether or not to wait for potential interest rate drops.

5. How can I secure the best mortgage interest rate?

To secure the best mortgage interest rate, there are several steps you can take. Firstly, make sure your credit score is in good shape, as this will heavily influence the rate you are offered. Next, shop around and compare offers from multiple lenders to ensure you are getting the most competitive rate.

Additionally, consider making a larger down payment if possible, as this can help lower your interest rate. It’s also important to choose the right mortgage term and type that aligns with your financial goals and circumstances. Lastly, be prepared to negotiate and discuss rate options with your lender to maximize your chances of securing the best rate available.

The Future of Mortgage Interest Rates IS NOT Good

Summary

So, to sum it up, mortgage interest rates are influenced by various factors like economic conditions, inflation, and the demand for loans. If the economy is doing well and inflation is low, rates tend to go down. On the other hand, if the economy is struggling and inflation is high, rates may rise. It’s hard to predict exactly where rates will go next, but keeping an eye on economic indicators can give you a sense of whether rates might increase or decrease in the near future.

When considering a mortgage, it’s a good idea to shop around and compare different lenders to find the best rate. Additionally, it’s important to keep in mind that even small changes in interest rates can have a big impact on your monthly payments and overall affordability. So, whether you’re buying a home or refinancing your mortgage, staying informed about interest rate trends and being prepared to act when rates are favorable can help you save money in the long run.

Remember, taking out a mortgage is a big financial decision, so it’s important to do your research and seek advice from professionals to make the best choice for your individual situation.